Dear Friends:

This week the SC General Assembly came together to make voting easy and safe for the November General Election.

No Excuse Absentee Voting

For those concerned about the safety of in-person voting on November 3rd, there are more options. The legislation we passed this week allows for ‘no excuse’ absentee voting for this election only. All voters will be allowed to cast absentee ballots as they did during the June primary. This ensures every voter has an opportunity to safely cast their ballot. The legislation sets Oct. 5th as the statewide start for absentee voting.

The bill strikes a good balance between protecting South Carolinian’s health and voting integrity. Democrat Representatives pushed amendments that would have removed the witness signature requirement and added unsecured drop boxes for depositing absentee ballots. Republican legislators rejected those efforts citing potential voter fraud. The absentee voting process in SC has worked well for decades and contains built-in voter verification checks that may be lacking in so-called ‘mail-in voting’ used by some other states.

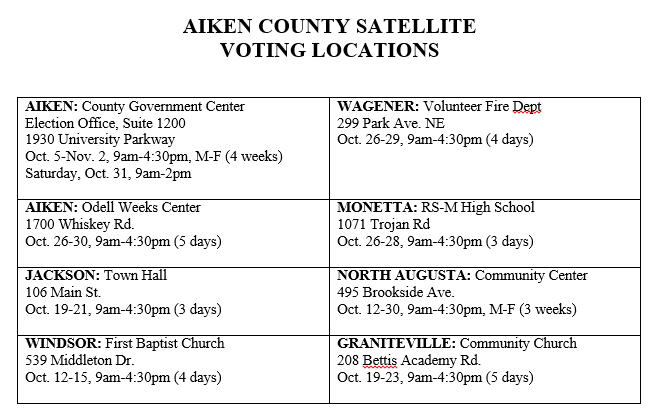

More Voting Opportunities in Aiken County

The Aiken Legislative Delegation has strongly advocated for more voting opportunities in addition to solely relying on mail-in absentee ballots. Aiken County voters may avail themselves of numerous satellite absentee voting places around the county during October. These satellite voting locations will allow voters to cast their absentee ballots in-person or drop off their paper ballot. Here are the locations and times:

Tough Times Call for Tough Decisions

The financial impact of the pandemic on SC is still unknown. The state’s economic forecasters confess they don’t have a good grasp of the pandemic economy going forward. They have told legislators they are learning as they go and warned that we need to tread carefully in spending money.

The forecasters admit the numbers they are seeing don’t make sense and the future is unpredictable; they say they are dealing with “Best Guesstimates”.

With that reality check, the House of Representatives this week wisely choose to shelve the budget recommendations that came from the Senate on Tuesday. The House opted to have state spending remain under the Continuing Resolution that spends at the rate of last year’s budget.

The Senate’s budget contained worthy priorities such as funding the step-increase in pay for public school teachers and a pay bonus for state employees. But what happens if tax revenues continue to drop as it did during the Great Recession?

Chairman of the House Ways & Means Committee, Rep. Murrell Smith, said he wants to give teachers and state employees a pay boost now – as senators proposed – but doesn’t want to risk having to lay them off later. Smith told reporters, “Let’s be careful and make sure we don’t make rash decisions that we regret later.”

The unknown is whether SC’s economy has bottomed out; there’s just not enough data to show if we are starting to improve. There are many factors ahead. As an example, the PPP expires Oct 1st and there is a legitimate concern there will be more employee layoffs without that federal assistance and state tax revenues are expected to be down when taxes are filed next April. One major economic indicator is SC’s hospitality/tourism industry which is forecasted to be down 30% through next spring. It’s currently down 60% in some sections of the state.

If the economy hasn’t fallen farther off a cliff by the time the General Assembly returns for a new session in January, there is a good chance the House will pass an interim budget for this fiscal year similar to what the Senate approved Tuesday. That would be a good alternative from a shooting-from-the-hip decision now.

CARES Act Funding

Money was allocated this week from the remaining portion of the federal CARES Act which is to help states weather the economic impact of the pandemic. Our mission was to allocate $668 million that wasn’t already allocated from the entire $1.9 billion chunk the state received earlier this year. Under congressional rules, that money must be spent by Dec. 31, or it reverts to federal coffers.

Both the House and Senate put the bulk of the remaining money into replenishing the state fund that pays unemployment benefits. The House also put more money toward grants for nonprofits and small businesses but capped them at $25,000. To review a summary of Phase II of the CARES Authorization click here.

Legislative Briefs

Raffles to Resume Soon: Both the House and Senate passed a bill (S-719) that will allow raffles sponsored by non-profit organizations to resume soon. The original legislation, passed five years ago, sunset in June when the legislative session was interrupted by the pandemic. That was fixed this week.

Tax Break: The House voted unanimously in favor of legislation (S-207) so those confined to a nursing home won’t be penalized by having the property tax on their home reassessed and increased. Their home would continue to be assessed at 4%. The legislation, sponsored by Sen. Tom Young (R-Aiken), also received a unanimous vote in the Senate.

Back to School Fulltime: State Education Superintendent Molly Spearman is pressuring local school districts to offer traditional, in-person learning for what she says are some of the state’s most vulnerable students. In a letter to school district leaders this week, Spearman encouraged schools to return to face-to-face instruction five days a week for “students who need it the most.”

I’m Available and AT YOUR SERVICE

It is my honor to be of service. If you need assistance during these trying times, navigating though the flow of information on COVID-19, navigating state government or have any thoughts or concerns about what the legislature, please do not hesitate to contact me.

In your Service,

Bill Taylor

Representative

South Carolina General Assembly

803-270-2012

Bill@taylorschouse.com

www.TaylorSCHouse.com

Newsletter not paid using taxpayer funds.

Legal Notice: This newsletter is not a solicitation for contributions to any SC registered lobbyist.