Dear Friends:

When I speak to elementary school students, I always ask them if they have heard their parents say, “It’s free; the government will pay for it?” Most agree. They are shocked when I tell them the government has NO MONEY! I follow up by saying that the government only has your parents’ money, which they pay through taxes.

That may seem obvious to you, but it’s a truism not everyone grasps – taxpayers pay, and the government spends. But you may be surprised, like those students, when you realize the tables can be turned.

Taxpayer Refund Proposed

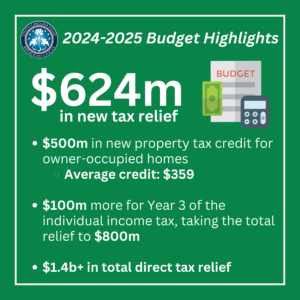

It was budget week for the SC House of Representatives. The House passed the first version of next year’s state budget that emphasized tax relief. With bipartisan support, the budget proposes over $1.4 billion in direct tax relief. That includes a $500 million property tax credit, providing an average credit of $359 per home. Additionally, individual income taxes would be reduced by $100 million more, along with the income tax cuts from the past two years, which will take over $800 million in total tax reduction.

It was budget week for the SC House of Representatives. The House passed the first version of next year’s state budget that emphasized tax relief. With bipartisan support, the budget proposes over $1.4 billion in direct tax relief. That includes a $500 million property tax credit, providing an average credit of $359 per home. Additionally, individual income taxes would be reduced by $100 million more, along with the income tax cuts from the past two years, which will take over $800 million in total tax reduction.

SC is BOOMING!

South Carolina is one of the fastest-growing states in the nation. People are moving here, businesses are starting here, and tourists are flocking here. Our environment, both for natural resources and the business, and taxpayer-friendly policies make SC a great place to live and do business. As a result, our economy has thrived. And when the economy thrives, the state budget grows. It’s a sign that SC is doing something right.

The booming economy has brought large budget surpluses these past few years, allowing the state to take care of many priorities. But budget growth has started to come back to historical norms. As a result, while we have new money, the lottery is down $48 million from last year, and the general fund total in this budget is over $700 million less than last year. The post-COVID boom has subsided, and expectations must be reset to normal levels.

Tightening Budget

This year’s General Fund budget is down from $13.9 billion last year to $13.2 billion this year. That’s almost a 5% decrease. The recurring budget growth is 5%. That is less than PopulationGrowth+Inflation of 5.4% — an essential metric for measuring government spending.

When you lower taxes, you create more economic activity. That’s what we believe. We are seeing the results of low taxes, business-friendly policies, and smart budgets.

While budget planning started with almost $1.7 billion in “new money,” a third was already committed to obligations such as adding to the state’s Reserve Funds and providing Tax Relief.

BUDGET HIGHLIGHTS

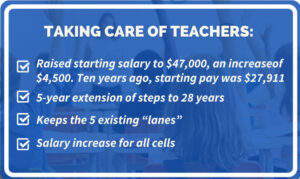

Taking Care of Teachers

This proposed budget continues the commitment to teacher recruitment and retention, with the most significant raises focused on the lowest-paid teachers with the fewest years of experience. It takes money to fill our teacher vacancies. $30 million is allocated to raise teacher’s salaries. Here are key facts:

This proposed budget continues the commitment to teacher recruitment and retention, with the most significant raises focused on the lowest-paid teachers with the fewest years of experience. It takes money to fill our teacher vacancies. $30 million is allocated to raise teacher’s salaries. Here are key facts:

- Vacancies Increasing: The number of reported vacant public school teaching positions has tripled in the last three years to 1,613.

- Fewer In-State Education Majors: In the last ten years, the number of education majors at our instate colleges and universities has decreased by 20%.

- Increased Demand for Teachers: Due to population growth, the number of public school teaching positions has increased by nearly 13% to 56,272.

- New Teacher Turnover: Nearly 70% of teacher departures last school year were by teachers with less than ten years in the classroom. Many quit in the first 3 to 5 years.

Also included in this budget is $30 million for the state’s educational scholarship program, which allows students to use up to $6,000 a year toward a private school or attend another public school.

Supporting Law Enforcement

I have repeatedly said, “Public Safety is the #1 priority of government.” Without public safety, society ceases to function. Just look at the current chaos in Hatti.

Accusations have been circulating on social media that this budget doesn’t support law enforcement. That comes from a handful of radical-right-wing Freedom Caucus. During two days of debate, they offered about 45 budget amendments. All were soundly defeated.

One of their attempted political stunts was to send $70 million to local governments for law enforcement. The state doesn’t fund local government employees; that’s a local government function.

Here’s the reality:

“I just want to tell y’all thank you for what you’ve done for all of state law enforcement, not just SLED, but all of state law enforcement over the past couple of years. What you have done with regards to pay for state law enforcement has been transformative without any question.” – Chief Mark Keel, SLED

Over the last five years, the state-supported law enforcement with over $400 million.

A correctional officer’s starting salary has increased 83% since 2013. SC Corrections Director Bryan Stirling called the salary increases from the last two budgets “a game changer.”

By getting state law enforcement to competitive salaries with other law enforcement positions and private employment, we have made state law enforcement competitive and created career paths for our officers.

Retaining State Employees

We must invest in our state’s most valuable resource – its people. Retaining employees is a challenge for every private business and industry today, and those challenges are no less daunting for state government. State government is competing with private sector wages and benefits that have skyrocketed in the past few years. Those factors propel the need to increase the salaries of state employees.

We must invest in our state’s most valuable resource – its people. Retaining employees is a challenge for every private business and industry today, and those challenges are no less daunting for state government. State government is competing with private sector wages and benefits that have skyrocketed in the past few years. Those factors propel the need to increase the salaries of state employees.

Caring for Veterans

South Carolina prides itself on being one of the nation’s most military and veteran-friendly states. This budget proposal demonstrates a substantial commitment to building and maintaining veterans’ nursing homes throughout the state.

Bridge Improvements

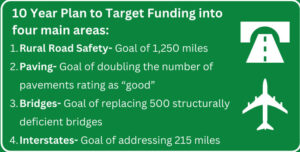

Improving SC’s roads and bridges is a high priority in budget planning, and the 10-year improvement plan continues.

Improving SC’s roads and bridges is a high priority in budget planning, and the 10-year improvement plan continues.

Seven years ago, complaints from constituents were at an all-time high about potholes, bad pavement, road drainage, or nearly undrivable dirt roads. Since then, complaints have dwindled because road improvements are evident all over South Carolina. Jarring potholes still appear, and there is crumbling pavement on older roads, but they are fewer because thousands of miles of roads have been repaved. New bridges are also being erected to replace dangerous and deteriorated older bridges.

fewer because thousands of miles of roads have been repaved. New bridges are also being erected to replace dangerous and deteriorated older bridges.

This budget makes another significant investment in our state’s infrastructure by investing an additional $200 million in our bridges. SC has 500 structurally deficient bridges, and their repair or replacement is a safety priority. This one-time expense is intended to speed up the bridge program.

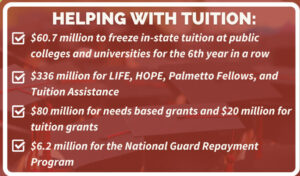

Capping Tuition Costs

Once again, parents of college students and those students paying their way receive the good news that the proposed budget continues to freeze tuition for in-state students at SC’s colleges and universities. Various scholarships (LIFE, HOPE, Palmetto Fellows, and Tuition Assistances are fully funded.

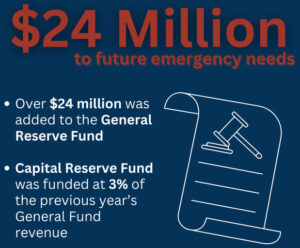

Rainy Day Funds

The first time I addressed the House of Representatives was in 2011. It was during the budget debate, which was challenged by significant economic challenges from the ‘Great Recession.’ My plea was to save money, not spend it unnecessarily. Like any family or business, having a sufficient financial cushion is comforting. This proposed budget continues that savings track. SC government has almost no debt, and we have over $1 billion in reserves.

The first time I addressed the House of Representatives was in 2011. It was during the budget debate, which was challenged by significant economic challenges from the ‘Great Recession.’ My plea was to save money, not spend it unnecessarily. Like any family or business, having a sufficient financial cushion is comforting. This proposed budget continues that savings track. SC government has almost no debt, and we have over $1 billion in reserves.

Other Funding

Other significant budget highlights include over $100 million dedicated to healthcare improvements and support for support for economic development initiatives like port expansion and business recruitment, positioning South Carolina for sustained growth.

The House also proposes to spend an additional $103 million on increased Medicaid costs.

$3 million was also allocated to hire an outside auditing firm to determine how $1.8 billion of unidentified money is sitting in a flow-through account. The money is not “lost,” as some say. It was not labeled correctly when the state switched computer systems. I chuckle when folks ask, “Who does the money belong to?” The obvious answer – taxpayers. The big question is – which state agency or agencies should have received the funds, and why didn’t they know it was “lost?”

Final Thoughts

We ensure a brighter future for all South Carolinians by prioritizing efficient government spending and strategic investments. Our fiscal responsibility and focus on core government functions demonstrate our commitment to the state’s prosperity.”

Everyone should remember that this document is just the first step in the budget process. It can and will change. But what was crafted by the House is a great starting point.

PICTURE OF THE WEEK

After many hours of budget debate, the Republican members of the Aiken Legislative Delegation still have smiling faces. L-R Front Row: Rep. Bill Hixon, Rep. Bill Taylor, Second Row: Rep. Bart Blackwell, and Rep. Melissa Oremus.

Want to Know More?

Do you want to learn more about my positions, bill sponsorships, voting record, and past writings? Here are some handy links:

- About Me: https://taylorschouse.com/about-2/

- My Positions: https://taylorschouse.com/issues/

- Sponsored Bill & Voting Record: http://tiny.cc/b1pouz

- Recent Newsletters: https://taylorschouse.com/category/newsletter/

I’m Available & AT YOUR SERVICE

It is my honor to be of service. Please do not hesitate to contact me if you need assistance navigating state government or have any thoughts or concerns about the legislature.

In Your Service,

Email: Bill@taylorschouse.com

www.TaylorSCHouse.com

Newsletter not paid using taxpayer funds.

Legal Notice: This newsletter is not a solicitation for contributions to any SC registered lobbyist.