Dear Friends:

The final two weeks of every legislative session feel like I’m in a paintball game with legislation flying fast and furious to get across the finish line before we adjourn. Today, I’ll focus on the BIG legislation that’s on the move.

Pathway to ZERO Taxes

A bold, conservative vision for tax reform took a major first step forward this week when the House Ways & Means Committee advanced the tax reform bill, sending it to the House floor. I was proud to vote in favor of it.

A bold, conservative vision for tax reform took a major first step forward this week when the House Ways & Means Committee advanced the tax reform bill, sending it to the House floor. I was proud to vote in favor of it.

It took a month of intensive analysis to smooth out the rough edges of the original state tax cut plan announced a month ago, but budget writers in the House found the sweet spot.

The latest version (H.4216) provides a path to an eventual 0% state income tax rate, and, when passed, would result in a tax cut for a vast majority of state taxpayers. The plan:

- Cuts state spending and devotes over $400 million to income tax relief

- Lowers the current 6.2% income tax rate to 5.39%

- Commits to additional spending cuts, setting a path of reducing state income tax rates to 1.99% over 5 years.

- Aims to eliminate the state income tax (ZERO PERCENT!) in 10 years

- Lowers SC rate, boosting jobs and competitiveness

- Quickly separates SC tax policy from Washington D.C. mandates

Factoids: Approximately 45% of all SC state revenues are derived from income taxes. 44% of South Carolinians don’t pay income taxes.

Under the revised plan, nearly 75% of tax filers will see either a reduction or no change in their tax liability in the first year. While residents in the lower six-figure range and at the lowest income levels would pay more, the increases would be modest, with an average increase of less than $50 for earners taking in less than $30,000 per year.

Under the revised plan, nearly 75% of tax filers will see either a reduction or no change in their tax liability in the first year. While residents in the lower six-figure range and at the lowest income levels would pay more, the increases would be modest, with an average increase of less than $50 for earners taking in less than $30,000 per year.

This plan calls for all existing state tax exemptions to remain. The first $30,000 in taxable income will be taxed at a rate of 1.99%, with every dollar after that taxed at a rate of 5.39. Growth in tax revenues is being used to flatten the tax burden on taxpayers and go further than the initial plan to potentially allow the state to eliminate the income tax entirely.

SUCCESS! Education Freedom for SC Parents & Students

Legislation allowing up to 15,000 K-12 students in SC to receive $7,500 scholarships next year to assist them with their education is headed to the governor’s desk after the House and Senate agreed to a compromise. School choice passed the House on a vote of 73-32, with only three Republicans joining Democrats in opposition. Gov. McMaster is expected to sign the bill quickly.

Legislation allowing up to 15,000 K-12 students in SC to receive $7,500 scholarships next year to assist them with their education is headed to the governor’s desk after the House and Senate agreed to a compromise. School choice passed the House on a vote of 73-32, with only three Republicans joining Democrats in opposition. Gov. McMaster is expected to sign the bill quickly.

School choice has been a top priority for Republican legislators since the state Supreme Court ruled that private tuition payments were unconstitutional last September. When the state stopped funding the original choice program, private donors stepped up to pay the tuition for about 800 students.

This legislation (S.62) will provide scholarships to 10,000 students whose families earn up to 300% of the federal poverty level. In 2026-2027, eligibility would increase to 15,000 students living in households with incomes up to 500% of the federal poverty level.

Through early application windows, public school students whose families make less than 300% of the federal poverty level would receive priority in receiving scholarships.

While the compromise doesn’t create universal school choice, legislators can invest more money in the program if more than 15,000 students apply. Ultimately, the state Supreme Court will decide if the law takes effect.

This is about giving every child a chance to succeed — no matter their ZIP code or income level. I promised to fight for more options and better outcomes for SC families, and I believe this bill delivers on that promise.

B-R-E-A-K-I-N-G

Meanwhile in Texas today, Gov. Greg Abbott signed SB2 into law, establishing the state’s first-ever school choice program: an education savings account (ESA) with universal eligibility. This is a game-changing moment. With this law, approximately 90,000 students across the Lone Star State will potentially be eligible to have access to flexible funds that can be used for private school tuition, tutoring, special education services, homeschool expenses, and more. As demand grows, the program will open to any student whose family chooses to enroll. This victory was hard-fought and years in the making. Texas is now the largest state in the nation to pass an ESA with universal eligibility!

Power ON!

This critical legislation aims to secure SC’s Energy Future. As our economy continues to grow, so must our energy infrastructure. I enthusiastically supported H.3309, the South Carolina Energy Security Act.

This critical legislation aims to secure SC’s Energy Future. As our economy continues to grow, so must our energy infrastructure. I enthusiastically supported H.3309, the South Carolina Energy Security Act.

The House amended the bill and returned it to the Senate. This legislation lays the foundation for a more dependable, affordable, and independent energy system. It reforms the Public Service Commission to increase transparency and oversight of utility companies. It encourages long-term investment in energy generation, including nuclear and renewables, to meet the demands of our booming economy and growing population.

I anticipate the Senate completing this bill before we adjourn Sine Die next week, and I expect Governor McMaster to sign it into law shortly after. A secure, modern energy grid is essential to SC’s future.

Hands Free in the Home Stretch

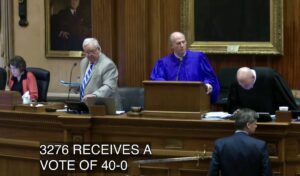

The SC Senate unanimously approved the HANDS-FREE cell phone bill for drivers (Eyes Up, Phone Down). Senators amended the bill to speed up enforcement and sent it back to the House seeking concurrence with the improvements so the bill can be sent to the Governor for his signature. Once it is signed into law, there will be a six-month education and warning period starting Sept. 1, then full enforcement set for March 1, 2026. WE’RE ALMOST AT THE FINISH LINE!

The SC Senate unanimously approved the HANDS-FREE cell phone bill for drivers (Eyes Up, Phone Down). Senators amended the bill to speed up enforcement and sent it back to the House seeking concurrence with the improvements so the bill can be sent to the Governor for his signature. Once it is signed into law, there will be a six-month education and warning period starting Sept. 1, then full enforcement set for March 1, 2026. WE’RE ALMOST AT THE FINISH LINE!

Boat Taxes Reduced

For weeks, my inbox has been flooded with emails from boat owners advocating that the legislature slash SC’s property tax rates on boats and watercraft. We are one of only a few states to charge property taxes on both boats and their outboard motors, effectively allowing some boats to be taxed twice. Topping that, SC’s tax rate on boats and motors is the highest in the nation at 10.5%. Boat owners are on the path to getting their wish. The House Ways & Means Committee approved H.3858, sending it to the floor for debate. SC

Counties are fighting the move, claiming they will lose tax revenues and may have to raise property taxes on everyone to offset the loss. I have a recommendation for counties. Cut your spending and don’t raise taxes. You have been gouging boaters for years. Give it up.

The SC Boating and Fishing Alliance contends that counties could potentially make that money back. Boat dealers suggest that approximately 78% of boats operating in SC valued at more than $120,000 are registered outside of the state, meaning property taxes are likely being paid elsewhere. Lowering SC’s tax could lure them back.

Casino Gambling Battle

Gambling is always a hot topic in the legislature. (Flashback – recall the video poker battle a quarter of a century ago? It was brutal.) The battle lines are again drawn in the newest gambling legislation (H.4176), which would legalize the state’s first gambling casino. It is being sold as a way to invigorate the economy in the I-95 corridor, particularly in Orangeburg County.

Gambling is always a hot topic in the legislature. (Flashback – recall the video poker battle a quarter of a century ago? It was brutal.) The battle lines are again drawn in the newest gambling legislation (H.4176), which would legalize the state’s first gambling casino. It is being sold as a way to invigorate the economy in the I-95 corridor, particularly in Orangeburg County.

This week, faith-based organizations that have joined forces in opposition to casino gambling swamped the State House to explain that what begins as a fun pastime can—and often will—quickly turn into a nightmare. For example, one university study concludes that the legalization of online sports gambling increases a household’s risk of bankruptcy by 25 to 30 percent.

On Wednesday, the House Ways & Means Committee sent the bill to the House floor on a vote of 12-9, setting up a potentially lengthy and heated debate. I voted against the bill in committee.

Liquor Liability Negotiations

This week, both House and Senate negotiators told reporters that the two sides are discussing a way to respond to bars and restaurants that say they could close their doors permanently without some measure of liquor liability. The final outcome is uncertain. The House is still taking testimony on the Senate Tort Reform bill (S.244). It is a complex issue that needs more time for testimony. However, the House has added its liquor liability bill to several Senate bills, hoping it can be the legislative vehicle to respond to bar and restaurant demands before wrapping up the session next Thursday. The House and Senate have not struck a compromise. They need to do so for the sake of our hospitality industry.

Incentive to Teach

Under a bill the House passed unanimously this week, teachers could count years of experience in another field toward their paychecks. The bill (S.78) returned to the Senate, and one more vote will send it to the governor’s desk for his signature. Specifically, the bill allows certified teachers to count every two years of work experience as one year of teaching in a similar subject matter. This could be a significant enticement to help shore up SC’s teacher shortage. Pay is often a leading deterrent for people looking to become teachers after years in a different field.

Paid Parental Leave for State Employees

State employees in South Carolina who become new parents could get twice as much paid leave under a bill (H.3645) that the House passed this week. The bipartisan bill was sent to the Senate on a vote of 86-18. It calls for state agencies, K-12 schools, and public colleges employees to have 12 weeks of paid leave after giving birth instead of six. Non-birthing parents, including fathers and adoptive parents, would qualify for four weeks instead of two. The House passed an identical bill three years ago but faltered in the Senate.

DELAYED: High School Sports Changes

Efforts to dump the controversial SC High School League and replace it with a new governing body have been postponed to next year.

According to SC Public Radio, the chief sponsor of H.4163, House Education Chair Shannon Erickson, said that recent discussions with the current SCHSL board left her encouraged that, for the first time in years, members of the governing board seem inclined to work with lawmakers to address lingering problems.

Legislators have long complained about league rulings concerning student athlete eligibility, league championships, and the roles charter and magnet schools should play in competition with public high schools.

Paid Parental Leave for State Employees

State employees in South Carolina who become new parents could get twice as much paid leave under a bill (H.3645) that the House passed this week. The bipartisan bill was sent to the Senate on a vote of 86-18. It calls for state agencies, K-12 schools, and public colleges employees to have 12 weeks of paid leave after giving birth instead of six. Non-birthing parents, including fathers and adoptive parents, would qualify for four weeks instead of two. The House passed an identical bill three years ago but faltered in the Senate.

State Treasurer Update

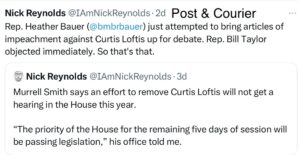

The SC Inspector General has opened an investigation over State Treasurer Curtis Loftis’ role in a $1.8 billion accounting error. The announcement follows a recommendation from the SC Senate last month that Loftis be removed from office.

The SC Inspector General has opened an investigation over State Treasurer Curtis Loftis’ role in a $1.8 billion accounting error. The announcement follows a recommendation from the SC Senate last month that Loftis be removed from office.

“I welcome this review and the opportunity to evaluate our actions independently,” said Loftis. He added that he had “proactively met” with Inspector General Brian Lamkin and State Law Enforcement Division Chief Mark Keel in late March. He said he encouraged them to investigate his office’s role in the incident thoroughly.

Meanwhile, one Democrat Representative tries daily to withdraw her impeachment legislation from committee and bring it to the House floor for action. On Wednesday, I objected, which scuttled her effort. House leadership said they will not act on the Senate resolution on Loftis’ removal this year, citing the fast-approaching end of the 2025 session next week.

Meanwhile, one Democrat Representative tries daily to withdraw her impeachment legislation from committee and bring it to the House floor for action. On Wednesday, I objected, which scuttled her effort. House leadership said they will not act on the Senate resolution on Loftis’ removal this year, citing the fast-approaching end of the 2025 session next week.

New Environmental Chief Confirmed

The Senate confirmed the governor’s choice for the first director of the state’s newly formed environmental agency this week. Myra Reece has been interim director of the 1,000-employee Department of Environmental Services since its formation last year, when legislators split DHEC in half, with the department overseeing public health and environmental regulations into two. Reece previously spent nine years as director of environmental affairs for DHEC.

The Senate confirmed the governor’s choice for the first director of the state’s newly formed environmental agency this week. Myra Reece has been interim director of the 1,000-employee Department of Environmental Services since its formation last year, when legislators split DHEC in half, with the department overseeing public health and environmental regulations into two. Reece previously spent nine years as director of environmental affairs for DHEC.

Closer to Home

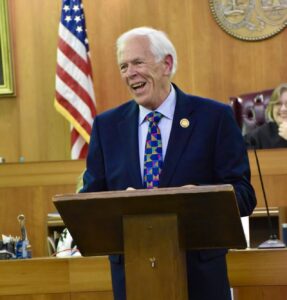

New Family Court Judge Takes Oath

Aiken’s Amanda Whittle took the Oath of Office Friday to become the newest Family Court Judge in this Judicial Circuit. At the age of 10, she decided she wanted to be a lawyer, and later, she dreamed of becoming a judge. I was honored to speak at her ceremony. I told the audience I have never met

Aiken’s Amanda Whittle took the Oath of Office Friday to become the newest Family Court Judge in this Judicial Circuit. At the age of 10, she decided she wanted to be a lawyer, and later, she dreamed of becoming a judge. I was honored to speak at her ceremony. I told the audience I have never met someone better suited to serve families. As the first State Child Advocate, she served as our state’s problem solver for children. As the head of a new cabinet agency, she had the authority to intervene in any state agency dealing with children. She was the advocate for children who needed her help. Amanda will be an extraordinary Family Court Judge. She has a heart of gold and cares deeply for people. She will strive to do the right thing in the myriad problems and challenges in family court.

someone better suited to serve families. As the first State Child Advocate, she served as our state’s problem solver for children. As the head of a new cabinet agency, she had the authority to intervene in any state agency dealing with children. She was the advocate for children who needed her help. Amanda will be an extraordinary Family Court Judge. She has a heart of gold and cares deeply for people. She will strive to do the right thing in the myriad problems and challenges in family court.

BIG EXPANSION!

Kimberly-Clark, a producer of personal care products, announced this week that it is expanding its operations in Aiken County. The company is investing more than $200 million and will create more than 150 new jobs.

Kimberly-Clark, a producer of personal care products, announced this week that it is expanding its operations in Aiken County. The company is investing more than $200 million and will create more than 150 new jobs.

Kimberly-Clark will add 1.1 million square feet to its existing facility in Beech Island. The expansion will streamline the company’s distribution footprint, significantly increasing its ability to ship directly from its mega-manufacturing facility on the same site. The facility will leverage advanced robotics, artificial intelligence-powered logistics systems, and high-density automated storage to improve operational efficiencies dramatically. Established in 1968, the Beech Island manufacturing facility is the company’s largest globally.

PHOTO OF THE WEEK

The Aiken County Legislative Delegation welcomed the Leadership Team of Aiken’s Horse Creek Academy to the State House. The Palmetto State Teachers Association sponsored their visit. Thank you, teachers!